11 Dec Dealing With Business Financial Pressure – There are Options

Before we get started let me say two things:

-

-

- Dave is not a real client. He could be, but he is a combination of several clients and our experiences with their business and their lives.

- Take advice early. It needn’t cost anything and it might make the difference to your financial survival.

-

Here is the Story of Dave – Please Don’t Be Like Dave!

Dave was the director of a steel fixing company. A few months ago after completing a contract for a large builder (Build Co.) he had a dispute about payment for his variations which had left his business tight on cash. As a result, his company had not paid its GST ($64,000), PAYG ($39,300), or Superannuation Guarantee ($11,250). Dave had also decided not to lodge his last 2 BAS returns to keep his debt with the ATO from getting any bigger in the hope they wouldn’t chase him until he had been paid.

Those returns represented GST of $57,200 and PAYGW of $18,400. His total ATO debts were now $178,900 with unpaid super sitting around $11,200.

After all, Dave knew he had done a good job and was confident he would be paid for the extra work he had done to make sure the builder would give him more work in the future. Doing a good job is enough right?

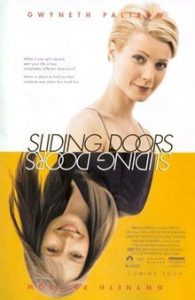

The Sliding Doors Moment

At this point, Dave thinks he might give us a call to have a chat about his options because he knows we have some construction and business experts on staff. This is Dave’s sliding doors moment, he has a relatively simple choice that could drastically change the future for him, even if he doesn’t know it at this point in time.

Dave chose not to call us.

Fast Forward 3 Months

Despite doing a great job, Dave had still not been paid and Build Co. was now threatening legal action against him for the work he had done. Another BAS return was due last week and had not been lodged. While his staff were all being paid, he had not been able to pay their Superannuation in full and he had also missed a couple of his own mortgage repayments preferring to pay some of the ATO debt instead. His business had managed to pay all costs since but he still had the costs of “that” job lurking in the background.

Dave has lost a bit of his faith and is doubting he will ever get paid for the work he has done at all without a costly legal battle. Dave’s personal life was also starting to suffer as the stress from the threatened legal action was taking its toll on him and his family.

Dave makes a decision to refinance his family home. This is the point Dave decides to call us, but only because he needs some information to refinance his house so he can get things back on track.

Our Advice to Dave

When speaking to Dave we find out about his situation and give him the following preliminary advice:

-

-

- Explain to Dave his legal obligations regarding payment of his business debts and in particular the Director Penalty Regime with the ATO.

- Lodge the current BAS return immediately – representing GST of $7,200 and PAYGW of $6,400.

- Engage with the ATO on a Payment Arrangement for the arrears.

- Let us review your situation and provide further advice about your legal options and personal liability.

- Outline the new credit reporting rules and how these may affect his ability to borrow.

- Meet with a specialist pre-insolvency partner who could provide a detailed plan to minimise the financial devastation of the past few months – This meeting was FREE and at a time and venue to suit Dave.

-

We had been working with Dave for a long time and he understood and trusted our expertise. He appreciated the advice provided and the explanations around his own personal liability for his business debts. Dave was sole shareholder and director of his company and had assumed he would be personally liable for his business debts. While the term pre-insolvency scared him he felt he had nothing to lose.

For a couple of weeks Dave felt he could relax while we spoke to the ATO and organised the Free meeting with our specialist pre-insolvency advisers.

The Pre-Insolvency Meeting and Detailed Advice

Dave was presented 3 options of which only Plan C was really viable due to the factors outlined below.

Plan A: Organise a Payment Arrangement and Trade Through

Dave had been working hard and had been cutting costs in his business where he could, including his own drawings. He had reduced his tax debt slightly but this had been at the expense of some creditors who were now starting to get nervous. The Tax Office however were not satisfied with the payment arrangement offered by Dave and sought further substantial reductions. Dave’s business was viable but the weight of the debt caused through his battle with Builder Co. had crippled his cashflow and left him with debts his business could not service.

Plan B: Borrow Money to Pay the Debts

Due to his own reduced drawings Dave had been late on his home loan payments for a few months. No big deal he thought because he had equity in his home and had a good relationship with his bank. With recent changes in the Credit Reporting rules, those late home loan payments mattered a lot because now the bank reported them and as a result, Dave’s credit score collapsed from nearly 900 to under 500 within a few months. Turns out, none of the main banks were interested in Dave anymore and because he had disengaged with the ATO, they too would soon be reporting his his tax debt to those same credit agencies.

Plan C: Restructure Dave’s Business

Dave’s pre-insolvency recommendation, and his only real option to avoid a complete financial disaster, was to restructure his business. The business was viable but had been struggling since Build Co. failed to pay their invoice.

The way things were heading, the company would face legal action by the ATO and even Build Co. so it was decided to restructure Dave’s business where the assets of the existing business are sold at commercial value to a related entity. This course of action allowed the debts of Dave’s business to remain with the existing company unless they are personally guaranteed or unless the ATO had personal recourse to Dave as a Director. Upon examination, Dave had personal liability for some of the PAYGW debt ($18,400), Superannuation Guarantee debts ($11,200), and a couple of supplier accounts he had personally guaranteed totaling around $20,000. That meant Dave was going to have to pay around $40,000 from total debts that were now well over $250,000.

Not only did Dave reduce his debt levels by over $200,000, all staff were re-employed by the new entity and all employee entitlements were assumed by the new company and offset against the purchase price of the business. Dave reached agreement with his trade creditors in relation to personal guarantees and ongoing business relationships and they were happy to keep his business, especially given his long standing relationship with them. The old company was liquidated and while the initial meeting and strategy proposal was free to Dave, the total cost of the restructure and liquidation of his existing business was around $35,000.

Summary of Dave’s Case

In total Dave had been put under financial pressure by Build Co. over an unpaid invoice that had resulted in Dave losing a bit of focus and his business debts blowing out to over $250,000 over a period of a few months. Eventually Dave spoke to our experts and received immediate advice to limit his personal liability for the debts of the business. Further advice received from specialist pre-insolvency advisers resulted in Dave having personal liability for around $40,000 of that debt with the rest being isolated within his existing company which was liquidated. The total cost to Dave to save over $200,000 was around $35,000 in advisor fees.

Had Dave not buried his head in the sand for a few month’s he could have achieved the same outcome with little or no personal liability for the debts of his business.

The Lesson to Take Away

-

-

- Get your business structure right.

- If Dave did not have the appropriate business structure in place he could not have achieved this outcome.

- Speak to us as soon as you face any financial pressures in your business.

- Had Dave called us at his sliding door moment he may have saved himself around a further $30,000.

- Get your business structure right.

-

If you are facing any financial distress in your business call us on (07) 54489600 or CLICK HERE to drop us a message.