02 Sep Construction Industry Contractor Payments Report

Update as at June 2019.

The ATO has always seen contractor payments in the construction industry as a significant tax risk. From 1 July 2018 the contractor reporting regime has been expanded to cover the following industries:

- Cleaning

- Courier

- Road Freight

- Information Technology

- Security, and

- Mixed services businesses providing one or more of the services above

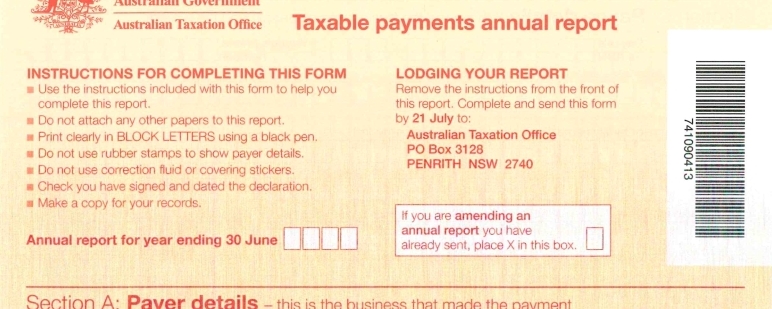

To combat that risk the law has been amended to require all businesses in these industries to complete and lodge a Taxable Payments Report showing all payments made to contractors.

The Taxable Payments Report must be completed and lodged by 28th August.

Who must complete the report?

All businesses paying contractors in the listed industries are required to complete the report by 28th August. The deadline for lodging the report is close to the end of the financial year so it is important to have appropriate systems in place to complete the report.

What Details do you need to report?

For each contractor, you need to report the following details each financial year:

- ABN, if known (if you don’t know the ABN you need to withhold tax from the payment)

- Their Name and Full Address

- The Gross amount you paid for the financial year (this is the total annual amount paid inclusive of GST)

- Total GST included in the gross amount you paid

CLICK HERE for more information from the ATO

What do you need to do now?

If you cannot easily collate the information required above then you may need to change how you record your contractor information.

Manually collating this information each year can be time consuming and costly so if you don’t already have an online accounting system ask me about how cheap and easy Xero can be for your business.

We are here to help so give us a call on (07) 5448 9600. Failing to lodge your Taxable Payments Report may result in penalties and the ATO may also use your noncompliance as a “reason” for an audit.